Features

Codes and standards

Hot topics

Dissecting dwelling insurance

Many Canadian property owners are under the impression that there is a single standardized formula for fire protection. They believe no matter where they buy a home, there is a standardized level of response from the nearest fire department.

November 1, 2010

By Michael R. Currie

Editor’s note: Parts 1 and 2 in our occasional series on insurance grading in Canada ran in the February and September issues of Fire Fighting in Canada and can be found on our website – www.firefightingincanada.com (click on past issues).

Many Canadian property owners are under the impression that there is a single standardized formula for fire protection. They believe no matter where they buy a home, there is a standardized level of response from the nearest fire department. Homeowners are often surprised to find many fire departments do not necessarily cross jurisdictional borders. They are also surprised to discover the cost of insurance may vary greatly from one property to the next, based on the community’s fire insurance grade.

|

|

| The system of fire insurance grading used in personal lines uses a scale of one to five; one represents the maximum possible credit for fire protection programs and five represents an unrecognized level of protection or no protection at all. Photo by Laura King |

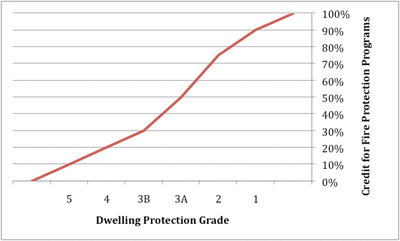

The system of fire insurance grading used in personal lines insurance is the Dwelling Protection Grade (DPG) system – an appropriate name, as personal lines insurers insure only detached dwellings (including duplexes). The system uses a scale of one to five, in which one represents the maximum possible credit for fire protection programs, and five represents an unrecognized level of protection or no protection at all.

How DPGs are determined

Similar to fire insurance grades for commercial lines insurance (explained in part two in September), the fire insurance grades for personal lines insurance are determined based on the capacity of the community to respond with a reasonable minimum amount of resources (within a specified time frame) for the level of risk being considered.

The greatest difference in the systems is in the quantification of the level of risk. In the commercial lines grading system, the level of risk is specifically determined for the built environment within that community, whereas the personal lines system considers a single level of risk to reasonably represent all detached dwellings.

This logic was reasonable when developed, but it may be less reasonable now as there is increasing variability in the size and degree of exposure. Additionally, new lightweight construction elements burn faster and, as such, the response timeframes may no longer be appropriate. The standard is being reviewed, and modifications may be forthcoming.

DPGs are typically applied to each fire station, but may, in some cases, be applied to an entire community (where a homogenous level of protection is provided). To determine the DPG of a fire station, the four main areas considered are fire department, water supplies, emergency communications and fire prevention. The specific requirements associated with each dwelling protection grade are published on the Fire Underwriters Survey website at www.fireunderwriters.ca.

To be recognized for fire insurance grading, there are specific minimum requirements for each DPG. While meeting the minimum requirements will result in the applicable fire insurance grade being applied, achieving this does not imply that a reasonable or adequate level of fire protection exists. One of the most common misconceptions around the DPG system is that the minimum requirements are a prescription for the amount of fire protection that a community should have. This is definitely not the case.

The table below provides a better representation of how the fire insurance grades are developed, and what they represent. If we consider the level of fire risk to be constant (as mentioned, this may not be true) for detached dwellings, and we quantify the response time, thereby making it a constant also, we can define terms for a reasonable and adequate level of response for a fully involved structure fire. The community is then measured against this benchmark, and the amount of credit received for fire protection programs is correlated with a fire insurance grade.

|

|

| Figure 1. Dwelling protection grades and credit for fire protection programs |

The system is not intended to be prescriptive; rather it is intended to encourage ongoing development of fire protection programs in communities. As communities grow and develop fire protection programs, additional credit is received and fire insurance grades improve.

The fundamental concept within fire insurance grading is the comparison of fire protection capacity against the calculated risk level (in terms of required fire flows). The Initial calculation of risk in terms of required fire flows gives a benchmark that fire protection capacities can be measured against.

|

|

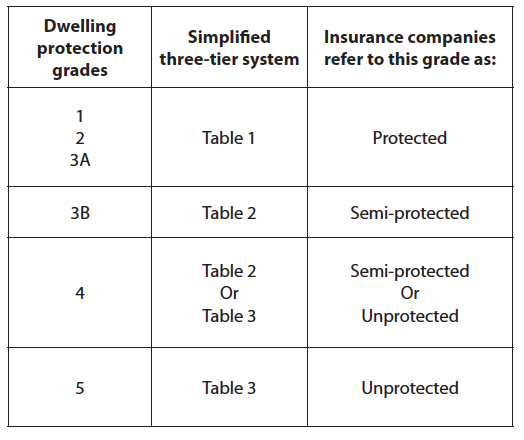

| Table 1. Dwelling protection grades and correlated insurance tiers |

How the insurance community uses dwelling protection grades

Each insurance company has its own methods of determining property insurance rates, but the majority of insurers use similar systems based on several criteria, including distances from risks to fire halls and hydrants and fire insurance grades.

Although the DPGs are separated into six levels, many insurers simplify these into three tiers – protected, semi-protected and unprotected.

Note that DPG 4 is treated differently from insurer to insurer based on case-specific relevant conditions. Most insurers interpret DPG 4 as either semi or unprotected.

An equivalency to 3A status may be granted to communities without hydranted water supplies that achieve superior tanker shuttle service accreditation through the Fire Underwriters Survey. Further information about superior tanker shuttle service accreditation is available at the Fire Underwriters Survey website at www.fireunderwriters.ca, and will be the topic of a future article.

Response distances

Fire Underwriters Survey uses eight kilometres by road as the maximum distance for coverage for personal lines insured properties. Some insurers specializing in rural risks may extend credit for fire stations with recognized fire insurance grades to distances beyond the recommended maximum.

Updating the DPG system

One of the greatest challenges for fire departments is maintaining roster levels to ensure that a minimum reasonable number of trained and equipped firefighters will be available to respond to fires in a timely manner. Changes are being considered with respect to how this is measured, the objectives that should be met and the recognized methods that can be used to meet the objectives.

Recently, terms of reference have been developed to clarify the DPG criteria. These have been published on the Fire Underwriters Survey website.

Updated GIS fire insurance grade maps are being created to clarify the grades for the insurers, and data is being collected from communities across Canada to facilitate this. Fire insurance grade maps are also useful to community stakeholders and fire departments, and may be very useful in strategic planning.

|

|

| The DPG system encourages communities to invest in water supply systems that are designed for firefighting purposes. |

How do communities benefit?

When communities first develop, and throughout the stages of growth, the DPGs provide a standardized framework that communities can use to plan their fire protection services to develop with the community. This is extremely important, as communities that strategically plan the location of fire stations will ensure that the maximum cost benefit for property owners is received through reduced insurance premiums.

The reduction in insurance premiums is very significant to owners of property insured under personal lines. Properties in communities with DPGs that correlate to protected status can receive as much as a 70 per cent reduction in annual insurance premiums compared to communities with unprotected status.

The DPG system encourages communities to invest in water supply systems that are designed for fire fighting purposes and fire fighting equipment, apparatus and training programs that are recognized for fire insurance grading purposes. This can be a strong leverage tool in a fire department’s arsenal for positively influencing change.

Numerous Canadian communities have shaped their investment in fire protection programs to strategically optimize the benefit to the constituents of the community.

The intent of the fire insurance grading program has always been to encourage sound investment in fire protection. The DPG system helps communities from the earliest stage of development to achieve recognition and the greatest cost benefit for their constituents.

Michael Currie is the director of Fire Underwriters Survey for western Canada and can be reached at michael.currie@scm.ca or 1-800-665-5661.

Print this page